Record trade deficit in March as exports plunge once again

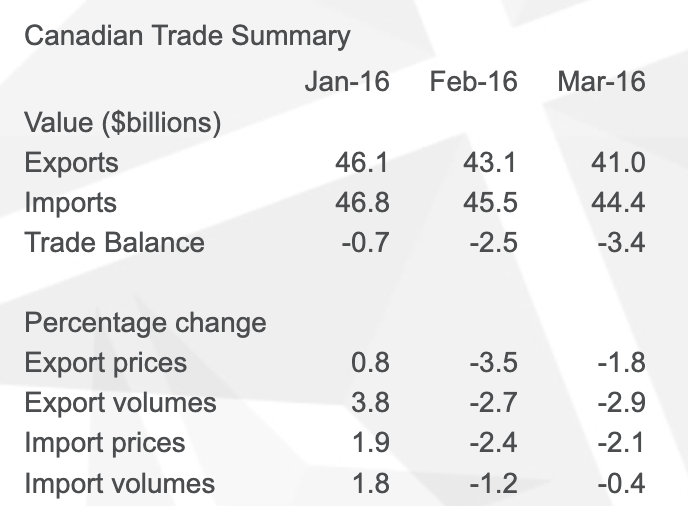

Canadian exporters are experiencing an abrupt reversal of fortune after a spike in shipments led to a record high for exports in January. In February, exports dropped sharply, wiping out two months of solid gains. In March, the downward momentum continued. Exports fell by 4.8 per cent to reach $40.1 billion. In a blink of an eye, Canada has gone from setting new records to posting the worst monthly export performance in more than two years.

Making matters worse, the decline in March was on top of a significant downward revision for February. When February’s trade numbers came out, it was reported that exports had fallen by 5.4 per cent to $43.7 billion. Those numbers have been adjusted to a 6.6 per cent decline and $43.1 billion.

The ink was red on the import side of the ledger as well. Like exports, imports were also down for the second consecutive month, falling by 2.4 per cent after a 2.6 per cent decline in February. Imports are now at their lowest level in a year.

Since the decline in exports far exceeded the decline in imports, there was a steep drop in Canada’s balance of trade in March. The trade deficit ballooned from $2.5 billion in February to a record $3.4 billion, eclipsing the previous low of $3.1 billion set exactly one year earlier.

Price and volume effects both played a role in the decline in trade in March. On the export side, trade volumes fell 2.9 per cent, while the prices Canadian businesses received for their goods were also down by 1.8 per cent, in spite of a stronger Canadian dollar and higher crude oil prices. On the import side, the impact was mostly on the price side (2.1 per cent decline), while import volumes were down only slightly.

The decline in exports was driven by dramatically lower shipments of goods into the United States. Exports to the US fell by 6.3 per cent in March and are down more than 13 per cent since January. Meanwhile, exports to non-US destinations were essentially flat. Gains in trade with the EU largely offset lower exports to China, India and Japan.

The good news for Canadian businesses that export into the US is that their experience in that market is not unique. Sluggish economic growth and lower business investment in the US have weakened demand for imports from around the world. Through the first quarter of 2016, total imports into the US are down 4.2 per cent.

The bad news is that Canada is performing worse than its competitors in the US market. Over the same period, Canadian exports are down 10.7 per cent (in US-dollar terms). Part of the reason Canada is underperforming is that energy products make up a significant share of Canada’s export mix and crude oil prices were about 30 per cent lower in early 2016 compared to a year earlier. Another factor is the exchange rate. Countries like Mexico have seen much more dramatic currency depreciation relative to the US in the past year or so (and a much weaker strengthening in recent months). As a result, Mexican goods are becoming relatively more competitive in the US market. US imports from that country were up 1.3 per cent in the first quarter of 2016.

Turning back to the Canadian numbers, the drop in exports was spread widely across the economy. Of the 11 major product categories, 10 posted declines. Only the aerospace sector escaped unscathed, as foreign sales in those industries were up 9.0 per cent. For their part, the losses were steepest for motor vehicles and parts producers, whose exports were down $514 million (6.0 per cent) compared to February. The auto sector had enjoyed a remarkable year in 2015, but is rapidly giving back those gains. Exports were also down significantly for metals, minerals and related products, as well as food, energy, pharmaceuticals and industrial machinery and equipment.